Overview

The American Cancer Society Cancer Action Network (ACS CAN) empowers advocates across the country to make their voices heard and influence evidence-based public policy change, as well as legislative and regulatory solutions that will reduce the cancer burden. As part of this effort, ACS CAN deploys surveys to better understand cancer patient and survivor experiences and perspectives, through our

Survivor Views research panel. The panel is a group of cancer patients and survivors who respond to regular surveys and provide important insights to support ACS CAN’s advocacy work at all levels of government.

Fielded January 2-22, 2023, our latest survey explores open enrollment, and the issues and priorities cancer patients and survivors consider as they make choices about purchasing health care coverage. The web-based survey was conducted among 1,279 patients and survivors nationwide who have been diagnosed with or treated for cancer in the last seven years. Of those, 57% have employer-provided health care coverage (722n), 28% are enrolled in Medicare (363n), 6% purchase their coverage privately such as through the marketplace (74n), and 5% are enrolled in Medicaid (66n). A combined 6% have some other type of coverage, no coverage, or aren’t sure.

Key Findings

- More than a third (38%) of cancer patients and survivors do not have a choice when it comes to their health care coverage and a majority of respondents would like more plan choices than they have.

- Seven in 10 (70%) would prefer to have a plan with a low deductible, but just 35% are enrolled in plan with a deductible lower than the IRS-defined high deductible of at least $1,400 per individual or $2,800 per family. Majorities of those enrolled in high deductible plans say it was their only choice.

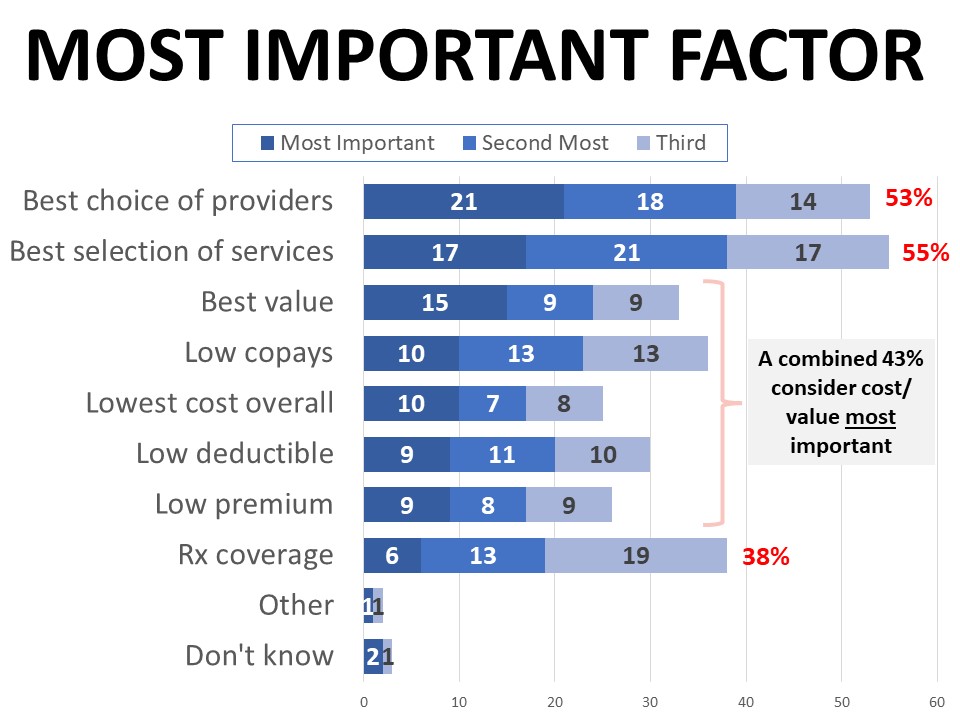

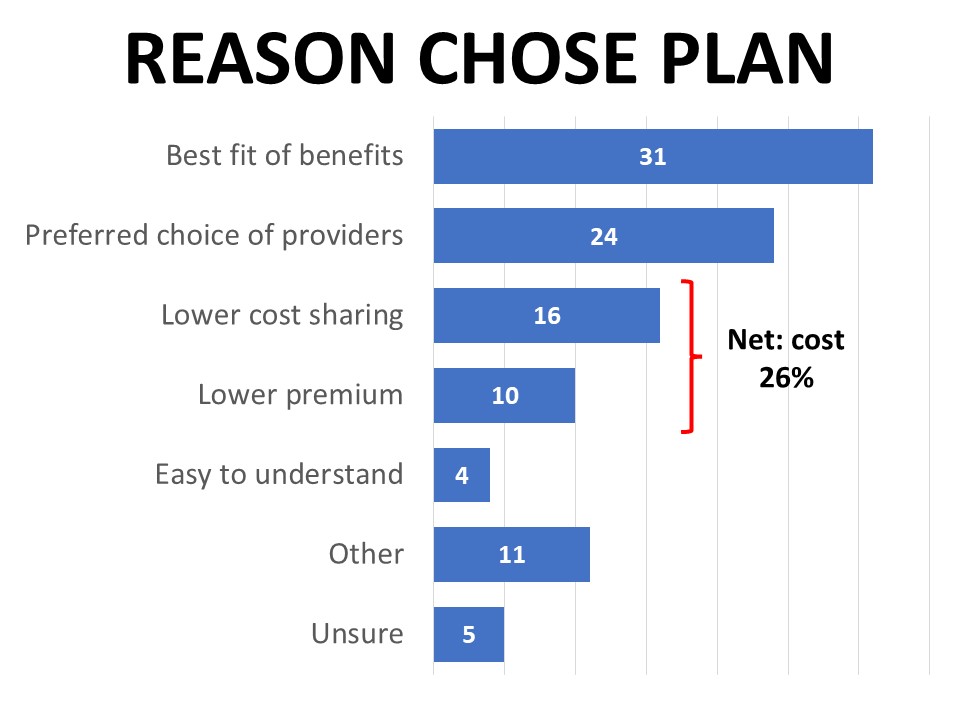

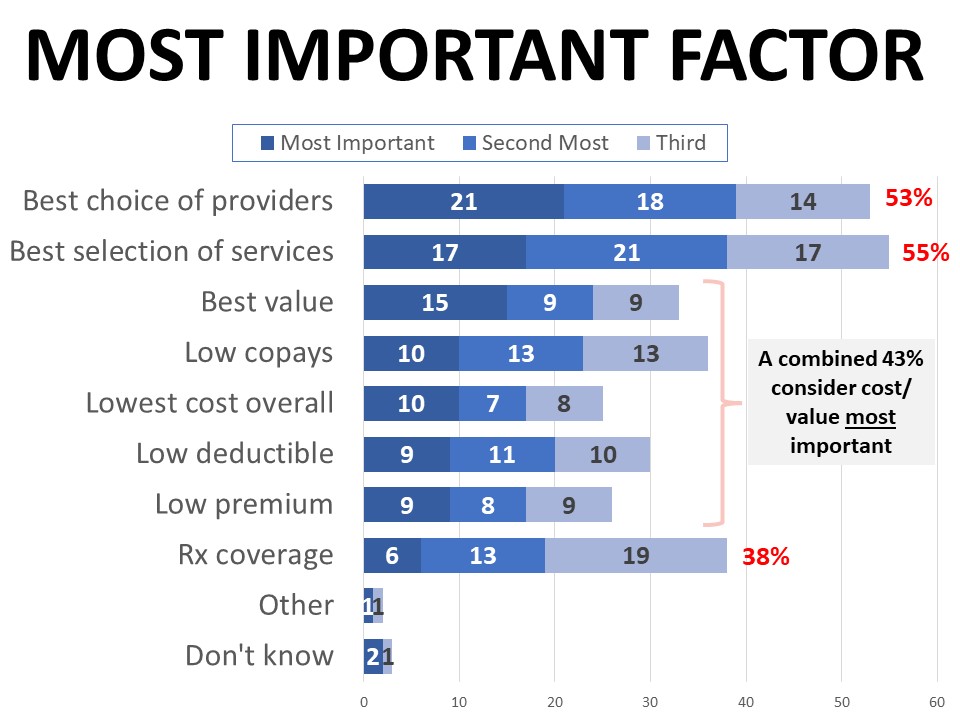

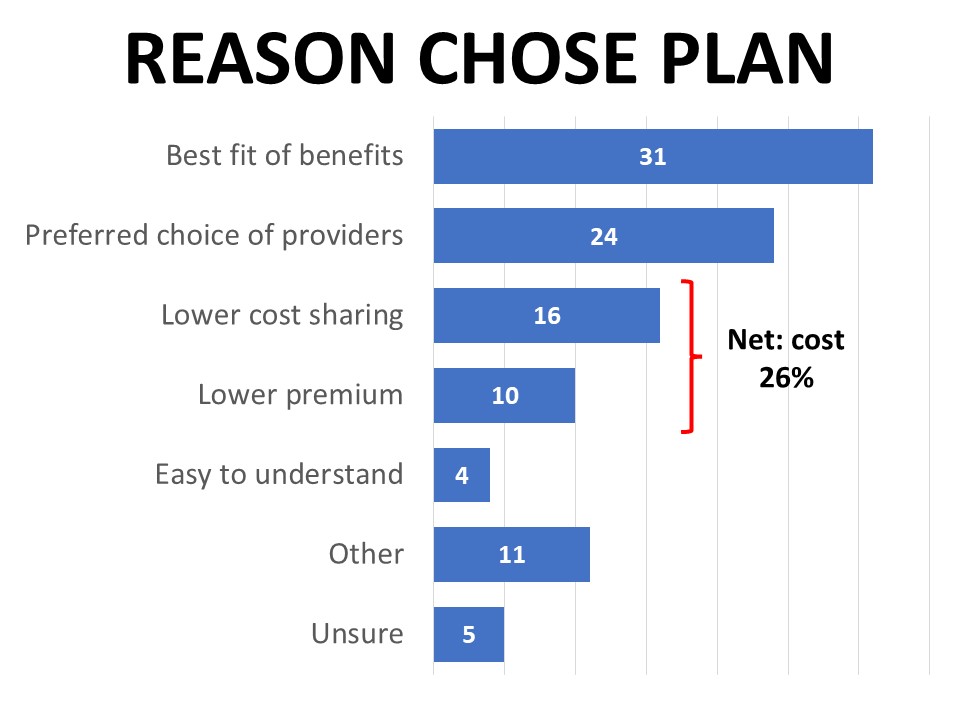

- Cost is considered the most important factor when it comes to comparing coverage options (43%), but the right mix of covered benefits is also essential and cited most often as the reason (31%) for choosing their current plan.

- One-third (33%) say what they look for in their coverage changed as a result of their diagnosis. Lower costs, covered services, and choice of providers dominate these shifting coverage concerns.

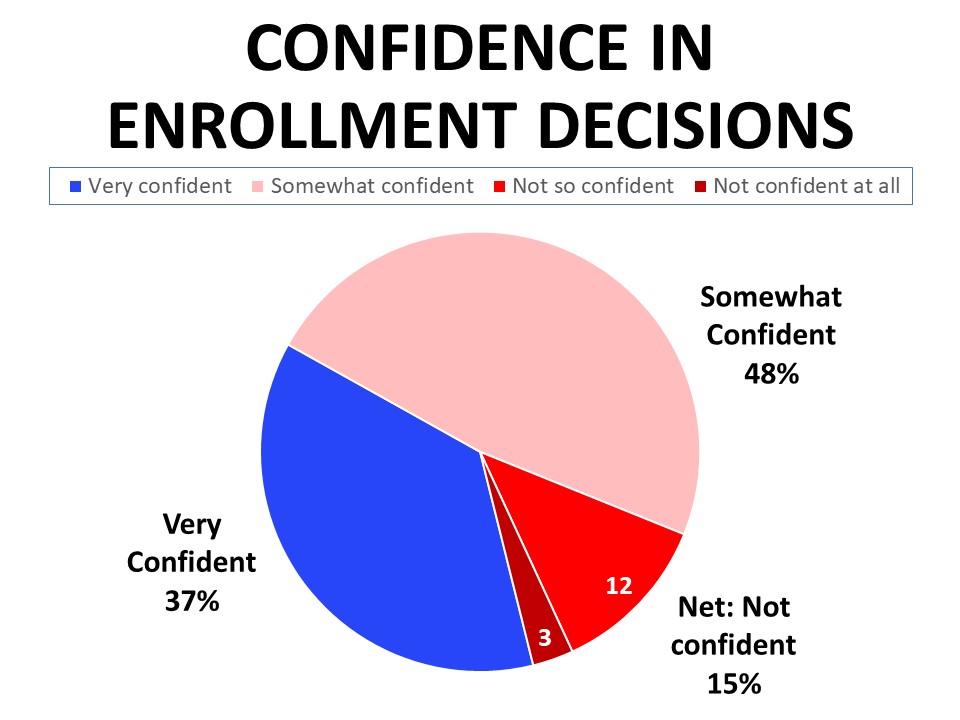

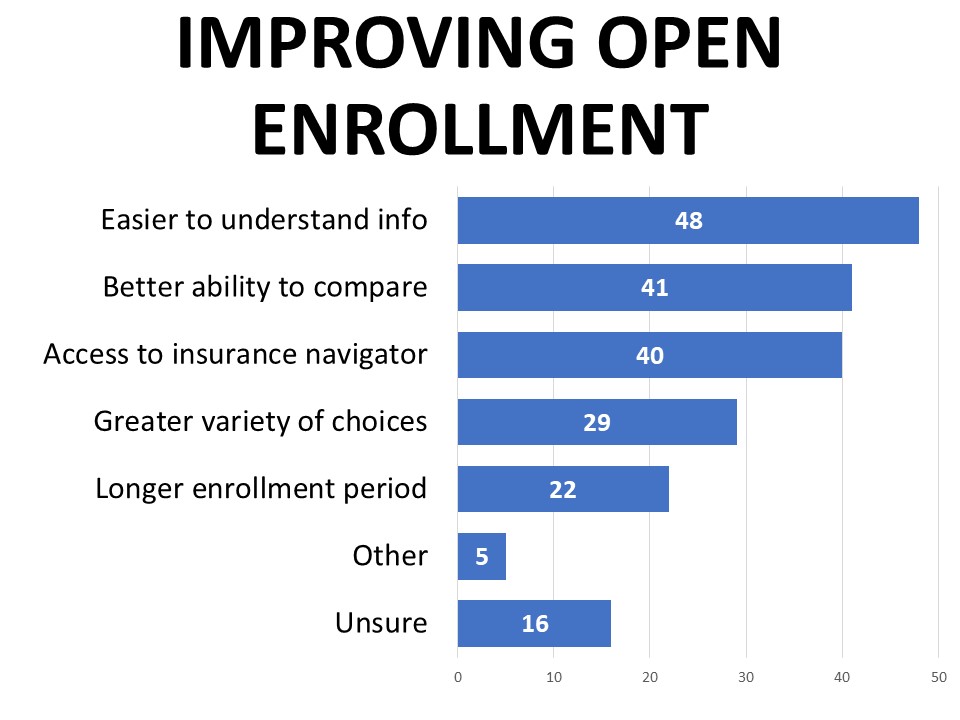

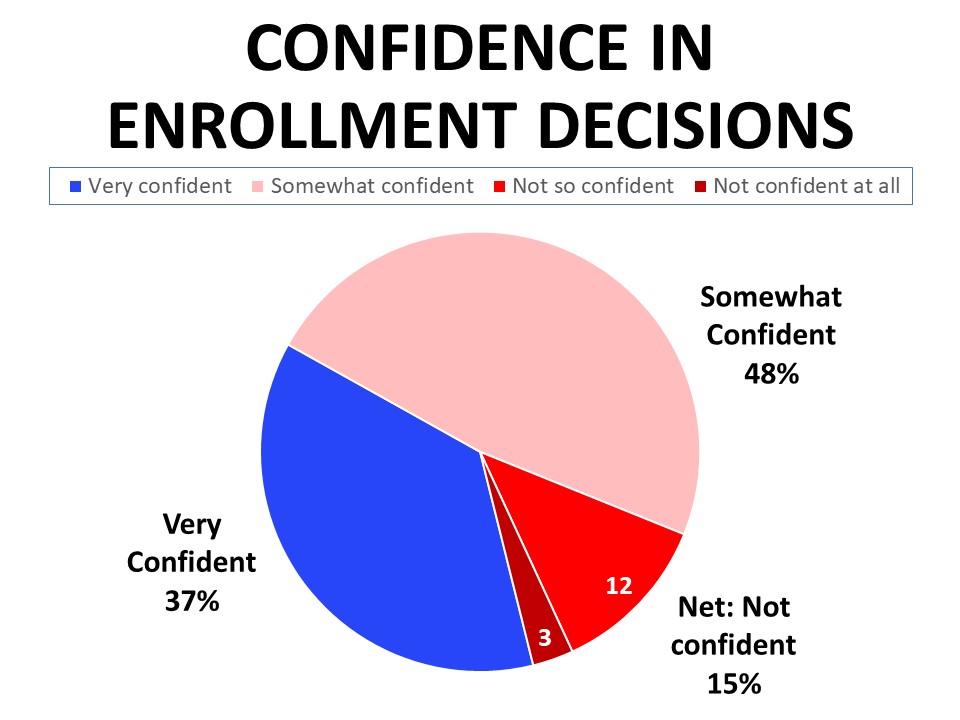

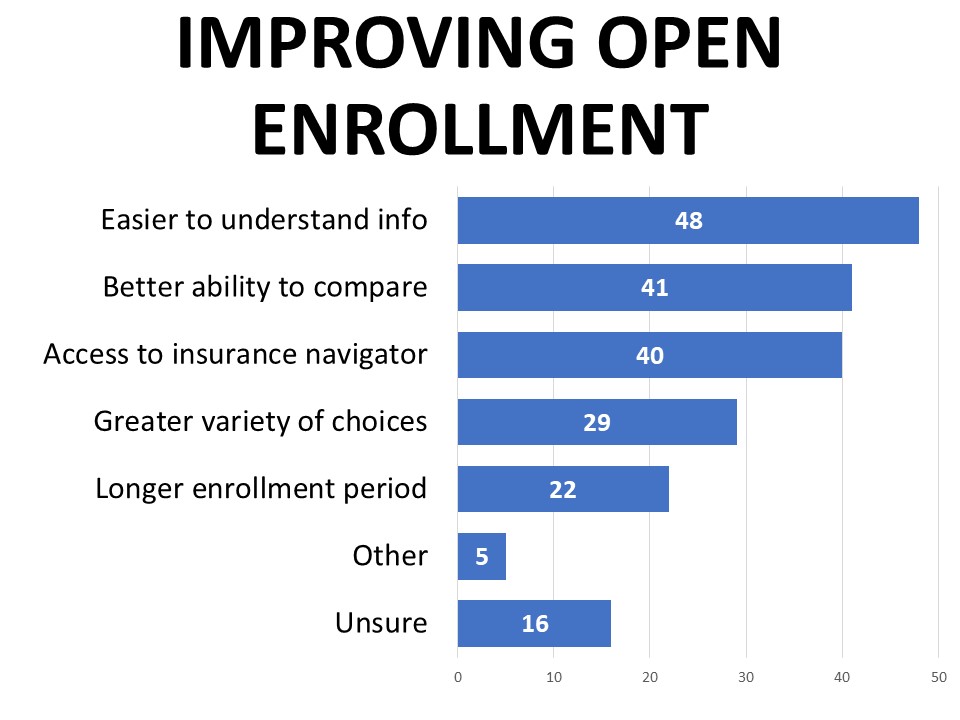

- A plurality (48%) only feel “somewhat” confident making coverage decisions, and clearer information, better ability to compare, and access to a navigator are highest rated as desired improvements to open enrollment.

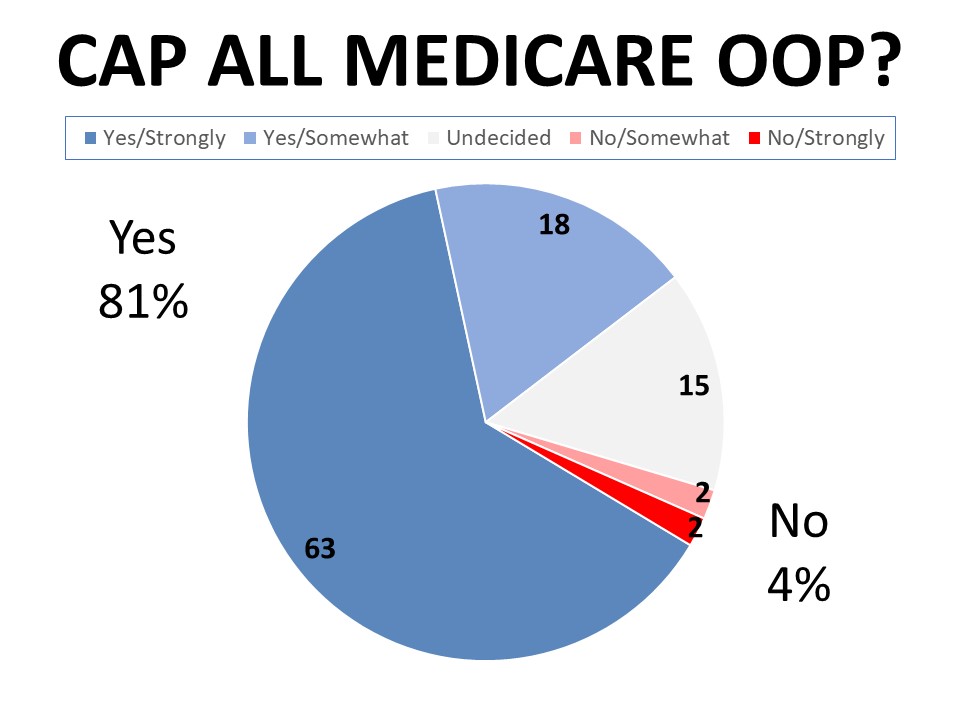

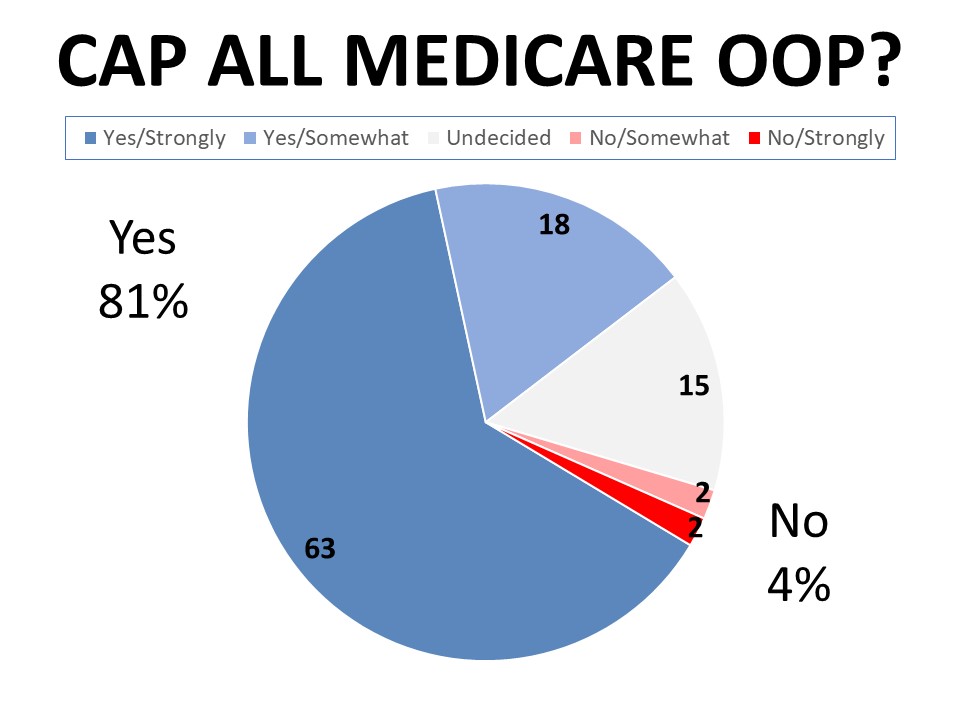

- Strong majorities support the provisions of the Inflation Reduction Act expanding marketplace subsidies and capping part D out-of-pocket drug spending for Medicare beneficiaries.

Detailed Survey Findings

More than a third do not have a choice when it comes to their health care coverage

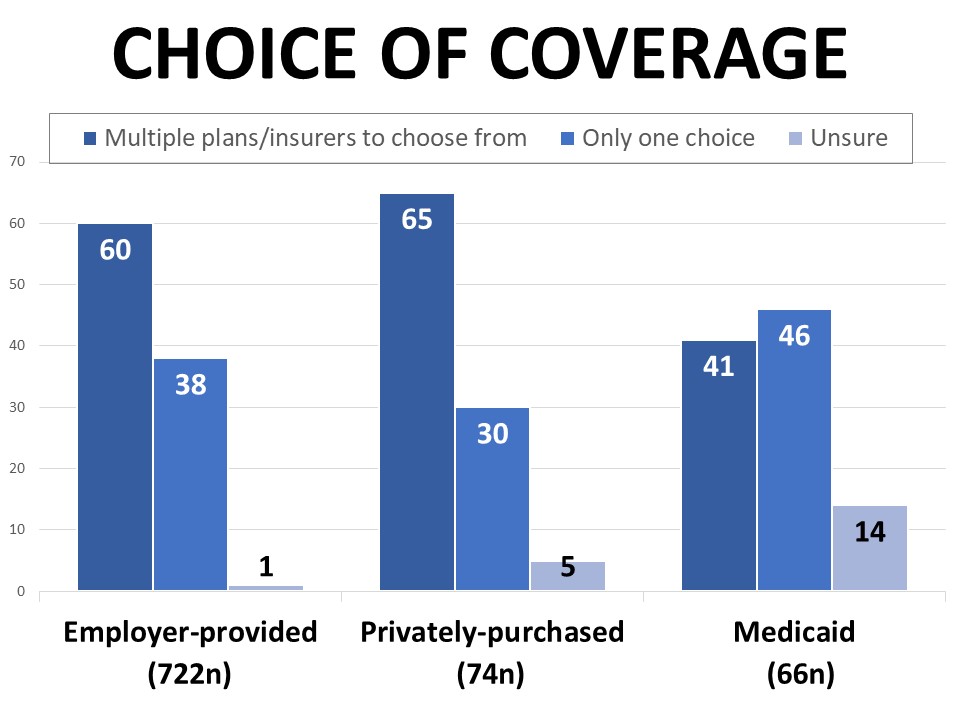

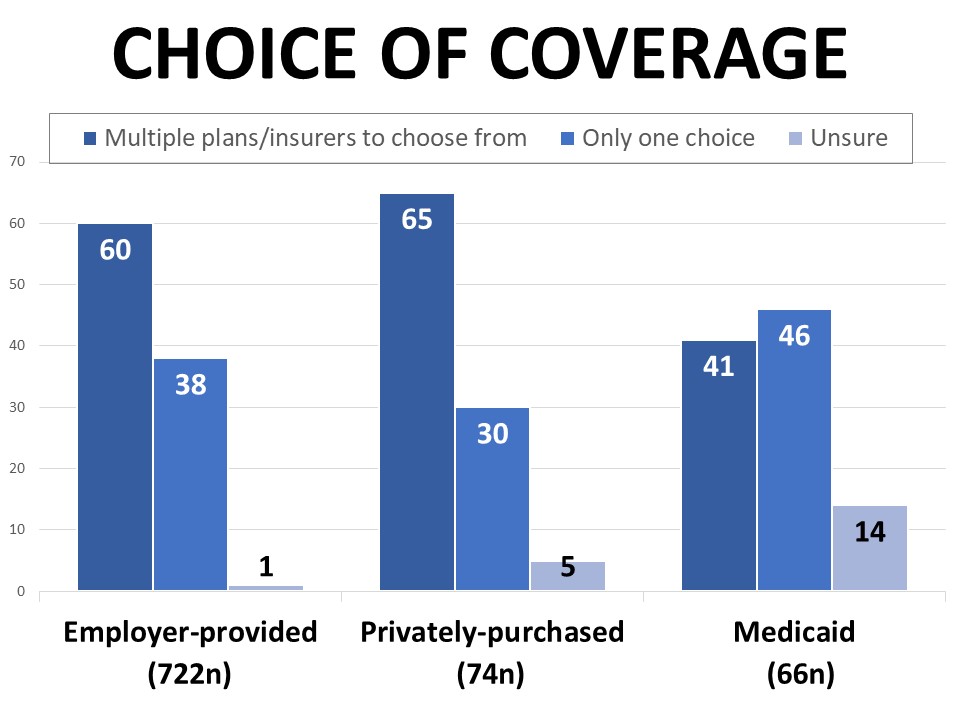

Fifty-eight percent of those surveyed report that they have a choice when it comes to their health care coverage, while 38% say there is only one option available to them. Those purchasing their coverage privately such as through the marketplace are most likely to say they have a choice (65%), followed by those with employer-provided coverage (60%), compared to 41% of those with Medicaid. Forty-six percent of Medicaid enrollees say there is only one option available to them, but another 14% aren’t sure if they have choices. By comparison, only 1% of those with employer-provided coverage and 5% of those purchasing coverage privately are uninformed about whether they have a choice.

Those enrolled in Medicaid are also most likely to say they aren’t sure what type of plan they have (55%), compared to 27% of those purchasing privately and just 15% of those with employer-provided coverage. Among the surveyed patients and survivors with employer plans, 63% say they have a managed care PPO, and 20% have an HMO. Among those with privately purchased coverage, 45% report their plan is a PPO and 26% are enrolled in an HMO.

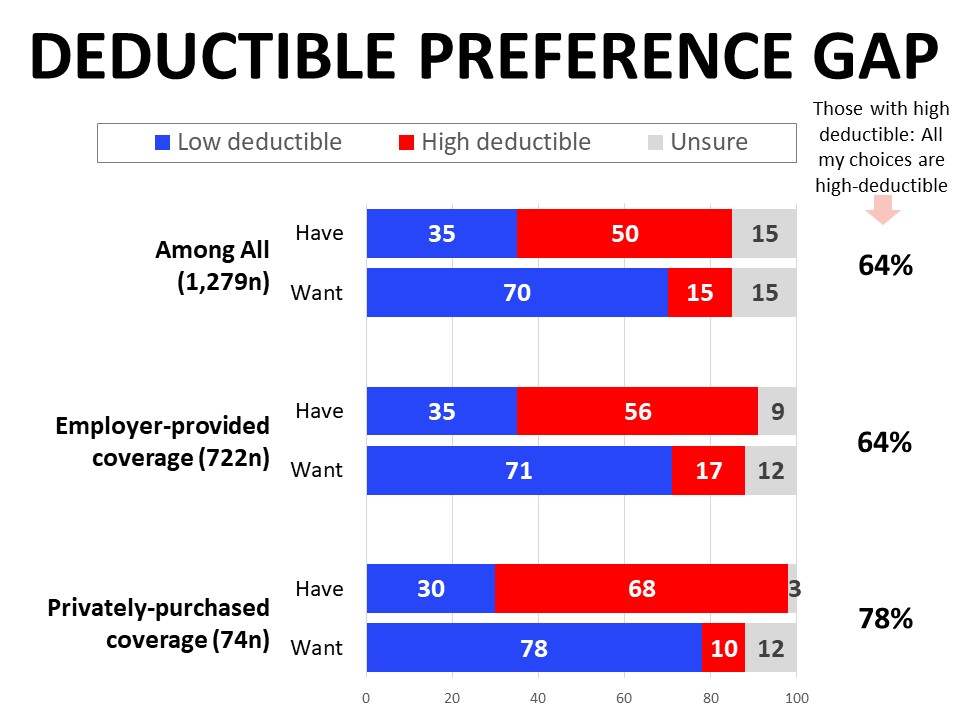

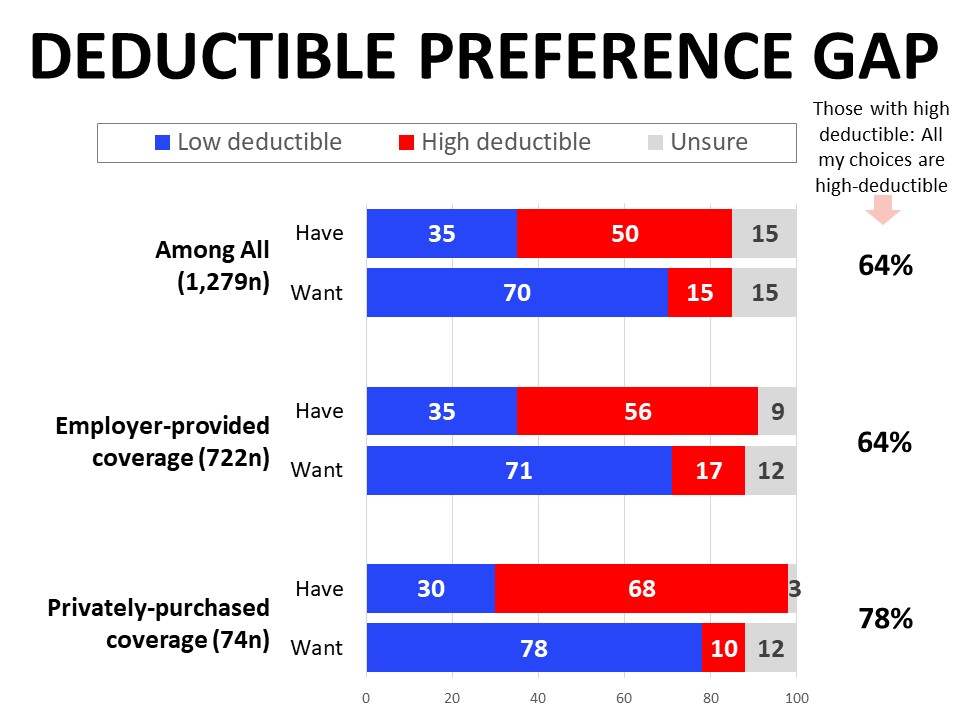

Most would prefer a low deductible plan, but only 35% have one

The groups differ significantly when it comes to the type of deductible they have, and there’s a significant gap between what they have and the structure they would prefer. More than one third of those with employer-provided coverage (35%) are enrolled in a low deductible plan, along with 30% of the private-purchase segment. Those with employer-provided plans are much more likely to have a high deductible plan with a health savings account or HSA at 31%, compared to 11% of those with privately-purchased plans. Those with privately-purchased coverage are most likely to report high deductible plans without an HSA (57%). Respondents across the board, however, agree that they would prefer to have a plan with a low deductible. Among those with a high deductible plan, about two-thirds (64%) say it was the only option available to them.

Cost is the most important factor in comparing plans, but the right mix of benefits covered is essential and often the reason a plan is selected

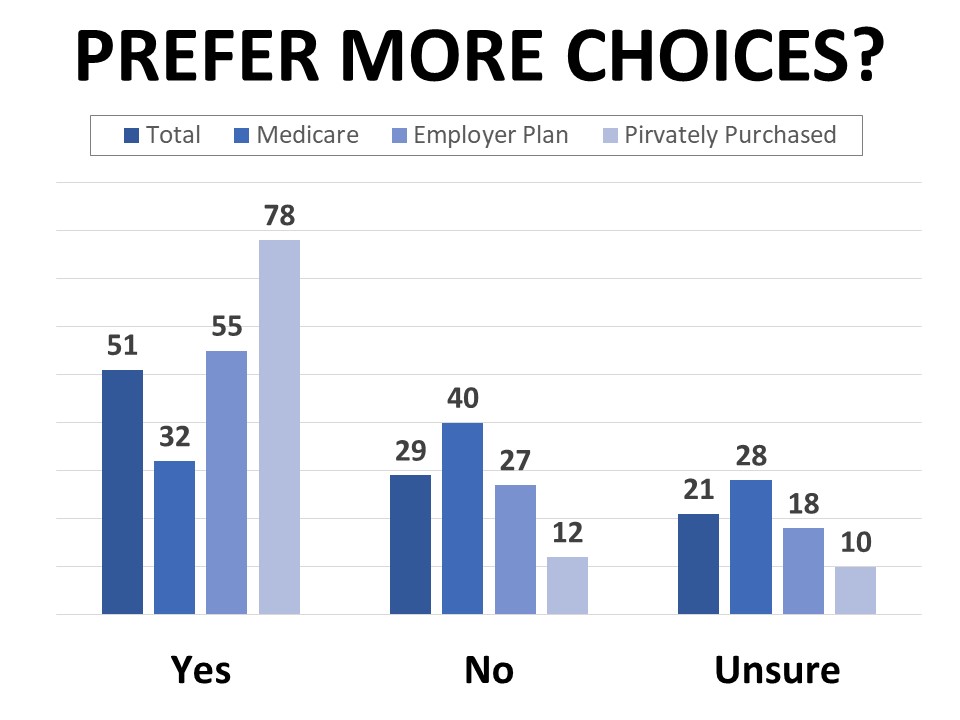

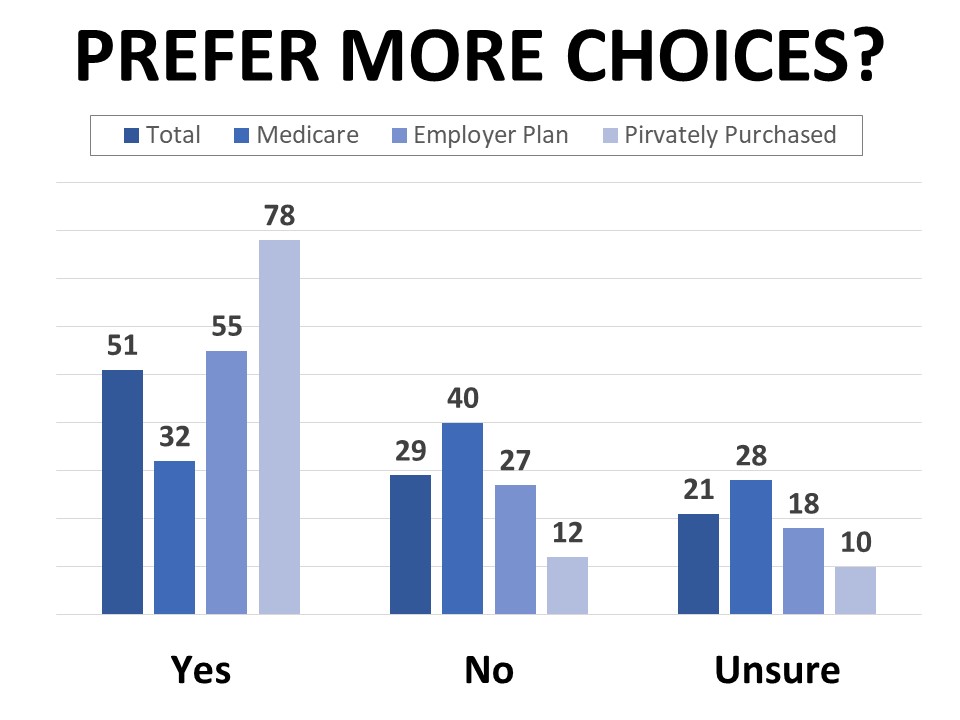

Most respondents would like to have more choices than they currently do, including 55% of those on employer-provided plans and 78% of those with marketplace or privately-purchased plans. Those enrolled in Medicare are least likely to say they’d like more options, however nearly a third of this group would also like to have more choices. The percentage wanting more choices is also higher among Black and Hispanic cancer patients and survivors (69% of each group), lower income households (62% of those in households earning $35,000 or less annually), and those who consider their own health to be poor (60%).

When asked what they want more choice in, plans offering more comprehensive coverage of benefits and services is most frequently cited (39%), followed by choice of providers (30%), choice of plans (20%), and choice of insurers (16%). About one-quarter want more choices but aren’t exactly sure which choices they’d like to have. Many of the 11% who specified another response mentioned lower costs or coverage of specific services or treatments. Dental, vision, and prescription drug coverage top the list of services and benefits for which cancer patients and survivors would like to have more choices.

Just over half (57%) actively shop for a health care plan every year, while nearly one-quarter only review their options when necessary due to changing circumstances such as a new job or family changes. A combined 43% say cost is the top factor they consider when choosing a plan, followed by choice of providers (21%) and selection of services (17%). However, a plan’s affordability doesn’t supersede the need for it to cover necessary benefits and services, which is cited by 31% as the main reason they selected their current plan. By comparison, 26% said they chose their current plan because it had the lowest cost, and 24% made their decision based on their preferred choice of providers.

Lower costs, covered services, and choice of providers dominate shifting coverage concerns after cancer diagnosis

One third (33%) of cancer patients and survivors say that what they looked for in their health care coverage changed after their cancer diagnosis. This is particularly true for those who purchase their coverage privately such as through the marketplace (57%), compared to 37% of those with employer-provided plans. Twenty-nine percent of Medicaid enrollees and 23% enrolled in Medicare also said their diagnosis led to changes in what they look for.

Many of the comments about what specifically changed in terms of what they look for in their coverage mention choosing a lower deductible, reducing out-of-pocket costs, choice of doctors and providers, and specific treatments and services covered. The most frequently mentioned specific benefits and services covered include prescription drugs, surgery, specialists, imaging, and lab tests. Illustrative comments include:

What specifically changed in terms of what you look for in health care coverage since your diagnosis?

“I need to make sure that I have very comprehensive coverage, and high deductible plans are no longer an option considering my medical needs. I also do not want to change oncologists, so I need a plan that is accepted at her clinic.”

“Before I never had to worry about my doctors being in network, or the coverage I had. I used to [search] a doctor by health plan, but now I can no longer do that due to all of the doctor appointments that I have. I also have to make sure that I have an open access plan because it’s too difficult to manage an HMO.”

“Coverage in another state as well as at home. One year, of the two choices of plans I had, one plan only covered my hospital system at home and the other one only covered the hospital system I traveled to for treatment.”

“I look for access to a specialty oncologist and clinical trials at a cancer center. Expensive drugs and frequent lab and x-ray tests made these issues a bigger priority.”

“Are my doctors included in the plan? Medications? Surgery and test coverage?”

One in seven surveyed (14%) say that if they’d had different coverage at the time of their diagnosis, it would have made a difference in their treatment, and 13% felt they made the wrong choice or regretted their choice of health care coverage. When asked what might have been different in their treatment under a different type of coverage, many cancer patients and survivors mention specific treatments they needed that were not covered. Out-of-pocket costs, surgical costs, and choice of doctor or hospital were also top mentions. These comments generally focus on increased costs, protracted timelines, or limited options due to their plan. Representative comments include:

What specifically would have been different with a different type of coverage?

“I would have gone to a major cancer treatment center out of my local area.”

“Time was wasted when I had to first see a general surgeon and then appeal to my insurance to allow me to see the breast cancer surgeon who specializes in my type of cancer.”

“I would have been seen and diagnosed earlier at stage I or II, not pushed off and not seen until it was critical at stage III+.”

“I would not have had to fight my insurer for over a month to get a PET approved for my diagnosis.”

“I would be healthier, tremendously less stressed without having to constantly for two years find providers on my own to treat my cancer.”

“I wouldn't be in debt for treatment. I had a very large deductible when I was diagnosed.”

Not all those who feel a different type of coverage would have made a difference in their treatment had negative experiences. Those who had a good experience also acknowledged that they may have been impacted negatively by a less desirable plan:

“I wouldn’t have had as many options.”

“I would not have been able to get the care, life-saving medication, and the stem cell transplant that saved my life then.”

“If I did not have the coverage that I had, my treatment would have been much more stressful. My plan covered treatment at 100% and I know not everyone has that much coverage. I may not have been able to heal as well if I had to stress about the final costs. Others going through treatment are not as lucky.”

Many are only somewhat confident making decisions about coverage, and want clearer information, better ability to compare plans, and access to a navigator

A plurality of 48% say they are only somewhat confident when it comes to making decisions about enrolling in health care coverage. While 37% say they feel “very” confident, another 15% don’t feel confident in making these decisions. The lowest income earners responding to the survey felt the least confident about making these decisions, with 27% of those with a household income of $35,000 or less saying they feel not very or not at all confident. Confidence in making enrollment decisions also correlated with perceptions of individual health. Those who rate their own health as excellent are most likely to say they are very confident making decisions about their coverage enrollment (53%), compared to just 20% of those who consider themselves to be in poor health.

Those who are enrolled in an employer-provided plan primarily get their information from their employer or human resources (92%), while those purchasing their coverage privately are most likely to say they get their information from their state healthcare marketplace or marketplace call center (51%). Medicare enrollees get their information from a mix of

insurance providers (33%) and insurance brokers or agents (33%). Those enrolled in Medicaid primarily receive their information from their state marketplace (41%). Friends and family and internet searches are cited as primary information sources for 13% of all respondents regardless of coverage type, while 7% say they get most of their information from their doctor or treatment provider. Just 3% say they get their information from advertising.

When asked how the open enrollment process could be improved, nearly half (48%) said they want easier to understand information, followed by a better ability to compare plans (41%) and access to a navigator (40%). Twenty-nine percent mentioned wanting a greater variety of choices and 22% want a longer enrollment period.

Those with employer-provided plans are more likely than others to want a longer enrollment period (26%), while those with marketplace plans are most likely to say they want a greater variety of choices (46%). Medicaid enrollees are most likely to say they would like access to an insurance navigator to help them make decisions (55%).

Strong majorities support provisions of the Inflation  Reduction Act impacting health care coverage

Reduction Act impacting health care coverage

Sixty-two percent of cancer patients and survivors support the expanded marketplace subsidies that make marketplace plans more affordable based on income level. Similarly, 60% agree the expansion of marketplace subsidies should be made permanent (41% strongly agree), while only 4% disagree. Just 16% of those surveyed know someone who has personally benefitted from the expansion of marketplace subsidies. Over two-thirds (68%) support the 2022 cap on part D out of pocket spending paid by Medicare beneficiaries for prescription drugs while only 3% oppose. Forty-one percent know someone who has been personally impacted by this cap. Eighty-one percent agree there should be a cap on all Medicare out of pocket expenses, with 63% agreeing strongly and only 4% disagreeing.

Methodology

ACS CAN’s

Survivor Views research initiative was designed to support the organization’s efforts to end suffering and death from cancer through public policy advocacy. Data provided by cancer patients and survivors as part of this project allows for a greater understanding of their experiences and opinions on cancer-related issues and gives voice to cancer patients and survivors in the shaping and advocating of public policies that help prevent, detect, and treat cancer and promote a more positive quality of life for those impacted.

To ensure the protection of all participants in this initiative all research protocols, questionnaires, and communications are reviewed by the Morehouse School of Medicine Institutional Review Board.

The survey population is comprised of individuals who meet the following criteria:

- Diagnosed with and/or treated for cancer within the last seven years

- Over the age of 18 (parents of childhood cancer survivors were invited to participate on behalf of their minor children)

- Reside in the US or US territories

Potential Survivor Views participants were invited to participate through email invitations, social media promotion, and partner group outreach. Those who agreed to participate after reviewing the informed consent information completed a brief survey including demographic and cancer history information to inform analysis as well as topical questions as discussed in this document. The data were collected between January 2-22, 2023. A total of 1,279 cohort participants responded to the survey. Differences reported between groups are tested for statistical significance at a 95% confidence interval.

About ACS CAN

The American Cancer Society Cancer Action Network (ACS CAN) makes cancer a top priority for policymakers at every level of government. ACS CAN empowers volunteers across the country to make their voices heard to influence evidence-based public policy change that improves the lives of people with cancer and their families. We believe everyone should have a fair and just opportunity to prevent, find, treat, and survive cancer. Since 2001, as the American Cancer Society’s nonprofit, nonpartisan advocacy affiliate, ACS CAN has successfully advocated for billions of dollars in cancer research funding, expanded access to quality affordable health care, and advanced proven tobacco control measures. We’re more determined than ever to stand together with our volunteers to end cancer as we know it, for everyone. For more information, visit

www.fightcancer.org.

Fifty-eight percent of those surveyed report that they have a choice when it comes to their health care coverage, while 38% say there is only one option available to them. Those purchasing their coverage privately such as through the marketplace are most likely to say they have a choice (65%), followed by those with employer-provided coverage (60%), compared to 41% of those with Medicaid. Forty-six percent of Medicaid enrollees say there is only one option available to them, but another 14% aren’t sure if they have choices. By comparison, only 1% of those with employer-provided coverage and 5% of those purchasing coverage privately are uninformed about whether they have a choice.

Fifty-eight percent of those surveyed report that they have a choice when it comes to their health care coverage, while 38% say there is only one option available to them. Those purchasing their coverage privately such as through the marketplace are most likely to say they have a choice (65%), followed by those with employer-provided coverage (60%), compared to 41% of those with Medicaid. Forty-six percent of Medicaid enrollees say there is only one option available to them, but another 14% aren’t sure if they have choices. By comparison, only 1% of those with employer-provided coverage and 5% of those purchasing coverage privately are uninformed about whether they have a choice.

Most respondents would like to have more choices than they currently do, including 55% of those on employer-provided plans and 78% of those with marketplace or privately-purchased plans. Those enrolled in Medicare are least likely to say they’d like more options, however nearly a third of this group would also like to have more choices. The percentage wanting more choices is also higher among Black and Hispanic cancer patients and survivors (69% of each group), lower income households (62% of those in households earning $35,000 or less annually), and those who consider their own health to be poor (60%).

Most respondents would like to have more choices than they currently do, including 55% of those on employer-provided plans and 78% of those with marketplace or privately-purchased plans. Those enrolled in Medicare are least likely to say they’d like more options, however nearly a third of this group would also like to have more choices. The percentage wanting more choices is also higher among Black and Hispanic cancer patients and survivors (69% of each group), lower income households (62% of those in households earning $35,000 or less annually), and those who consider their own health to be poor (60%).

insurance providers (33%) and insurance brokers or agents (33%). Those enrolled in Medicaid primarily receive their information from their state marketplace (41%). Friends and family and internet searches are cited as primary information sources for 13% of all respondents regardless of coverage type, while 7% say they get most of their information from their doctor or treatment provider. Just 3% say they get their information from advertising.

insurance providers (33%) and insurance brokers or agents (33%). Those enrolled in Medicaid primarily receive their information from their state marketplace (41%). Friends and family and internet searches are cited as primary information sources for 13% of all respondents regardless of coverage type, while 7% say they get most of their information from their doctor or treatment provider. Just 3% say they get their information from advertising. Reduction Act impacting health care coverage

Reduction Act impacting health care coverage