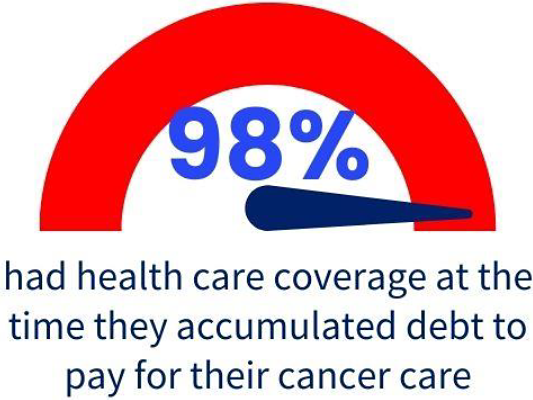

Medical debt impacts many people with cancer, their caregivers and their families. ACS CAN has long fought for public policies – like access to comprehensive and affordable health insurance coverage – that reduce the likelihood or severity of that debt. Unfortunately, many Americans remain uninsured or underinsured and even those with comprehensive coverage can still incur significant medical debt. 1,2 People with cancer often bear significant health care costs because they can have substantial health care needs, are high utilizers of health care services, use many different providers, and sometimes require more expensive treatments. They also must pay many indirect costs, like transportation and lodging as well as losing wages due to unpaid time off or job loss, that add to their already heavy cost burden.

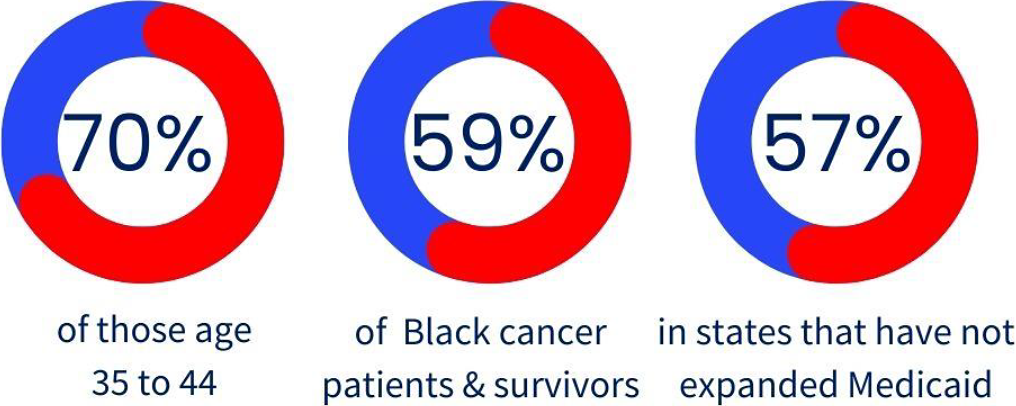

In March & April of 2024, ACS CAN asked people with cancer and survivors about their experiences with medical debt through a Survivor Views survey. The survey found that nearly half of the cancer survivors surveyed carried medical debt related to their cancer treatment:

Survivor Views on Medical Debt

|

49% of those with debt owed over $5,000

35% have carried their debt for more than three years

55% have gone to collections

49% say their debt has hurt their credit score

|

| Survivor Views survey conducted March 18 – April 14, 2024 among 1,284 cancer patients and survivors. www.fightcancer.org/survivor-views for more information. |

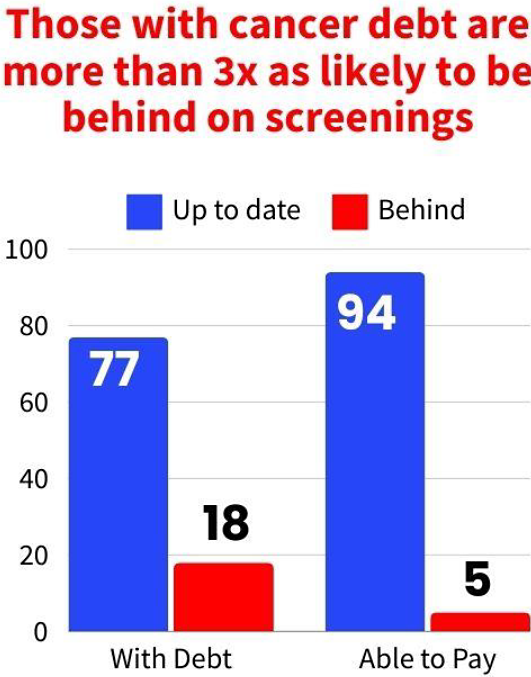

Other research also documents the negative effect medical debt has on people with cancer including housing concerns, strained relationships,3 and bankruptcy.4 Delaying or forgoing care because of cost, which is more common among people with medical debt, is associated with increased mortality risk among cancer survivors.5 U.S. counties with higher levels of medical debt are also more likely to have significantly higher rates of cancer mortality.6

The American Cancer Society Cancer Action Network’s Position

Addressing medical debt in the U.S. is crucial to accomplishing ACS CAN’s mission of ending cancer as we know it for everyone. In order to effectively achieve that reality, all individuals must first and foremost have access to quality and affordable health insurance coverage. That is why ACS CAN has long supported public policies that make insurance options with affordable premiums, comprehensive benefits and affordable cost-sharing available to all individuals.

| To further make health care affordable, ACS CAN’s goal is to prevent people with cancer, survivors, caregivers and their families from incurring debt as a result of necessary cancer treatment. Where medical debt cannot be prevented, our aim is to minimize the negative impacts medical debt has on a patient’s health, quality of life, and financial wellbeing. |

ACS CAN urges federal, state and local policymakers to:

-

Prevent the occurrence of medical debt by improving and expanding provider financial assistance programs, ensuring patients can use discount/assistance programs7 for prescription drugs and resolving medical billing issues before they impact patients – particularly those from underserved populations – by enacting policies that:

- Ensure patients are screened for and directed to available financial assistance programs before they receive care;

- Make financial assistance programs available to more patients, and through more provider-types;

- Require providers to screen and advise patients regarding their financial assistance program (as applicable) before billing the patient and in any subsequent communication;

- Strengthen regulation of existing rules regarding financial assistance programs, including increasing transparency and data collection;

- Ensure patients do not receive surprise medical bills; and, if they do, have available information on how to report/resolve the charges;

- Increase access to patient navigation services that include financial counseling and connections to financial assistance programs for patients and their families; and

- Ensure patients using prescription drugs can receive the full financial benefit from any patient assistance or drug discount programs available.

-

Reduce the impact of incurred medical debt on individuals and families by enacting policies that:

- Remove all medical debt as a factor in considering an individual’s credit worthiness;

- Minimize the selling of individuals’ medical debt to third party debt collectors;

- Prohibit collection practices for medical debt that are predatory, discriminatory, and/or extraordinary;

- Prohibit debt collection actions while individuals are appealing the claim that is the subject of the debt;

- Limit interest rates charged on medical debt; and

- Prohibit medical payment products from using practices that are predatory and/or damaging to the cardholder’s financial health.

-

Develop innovative and impactful ways to eliminate medical debt and provide patients with alternative funding mechanisms for their cancer-related care or debt payments that meet the goals stated above.

References

- Banegas MP, Guy GP, de Moor JS, et al. For Working-Age Cancer Survivors, Medical Debt And Bankruptcy Create Financial Hardships. Health Aff (Millwood). 2016;35(1):54-61. doi:10.1377/hlthaff.2015.0830

- Death or Debt? National Estimates of Financial Toxicity in Persons with Newly-Diagnosed Cancer - The American Journal of Medicine. Accessed April 9, 2021. https://www.amjmed.com/article/S0002-9343(18)30509-6/fulltext

- Banegas MP, Schneider JL, Firemark AJ, et al. The social and economic toll of cancer survivorship: a complex web of financial sacrifice. J Cancer Surviv. 2019;13(3):406-417. doi:10.1007/s11764-019-00761-1

- Ramsey SD, Blough DK, Kirchhoff AC, et al. Washington Cancer Patients Found To Be At Greater Risk For Bankruptcy Than People Without A Cancer Diagnosis. Health Aff (Millwood). 2013;32(6):1143-1152. doi:10.1377/hlthaff.2012.1263

- Yabroff KR, Han X, Song W, Zhao J, Nogueira L, Pollack CE, Jemal A, Zheng Z. Association of Medical Financial Hardship and Mortality Among Cancer Survivors in the United States. J Natl Cancer Inst. 2022 Jun 13;114(6):863-870.

- Xin Hu, Zhiyuan Zheng, Kewei Sylvia Shi, Robin Yabroff, and Xuesong Han. Association of medical debt and cancer mortality in the US. Journal of Clinical Oncology 2023 41:16_suppl, 6505-6505

- For more information about financial assistance programs (sometimes known as charity care) and requirements, see https://www.consumerfinance.gov/ask-cfpb/is-there-financial-help-for-my-...