The Costs of Cancer 2020 report includes many graphics that illustrate the costs cancer patients face and why policymakers much find solutions. Six infographics in English and Spanish provide a snapshot of key findings from the report.

Some Insurance Plans Come with Higher Patient Costs

The Problem

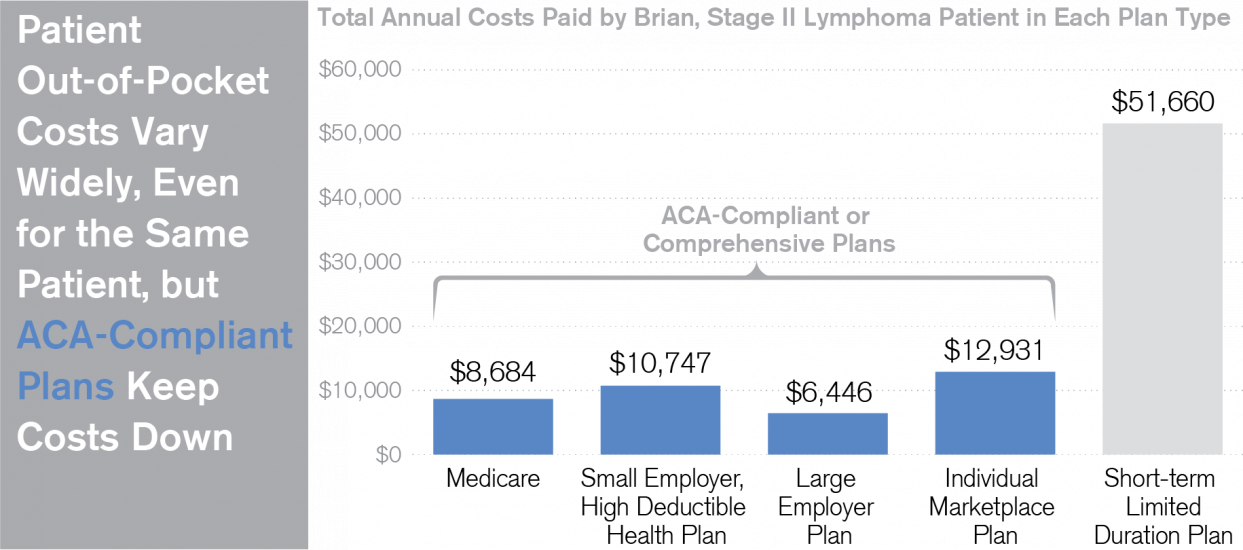

The Affordable Care Act (ACA) has helped individuals with pre-existing conditions like cancer access comprehensive health insurance and afford their care. But the law is at risk of being dismantled. The risks of losing ACA protections are clear when you look at current plans that do not have to play by ACA rules. Short-term limited duration plans often attract enrollees with low premiums, but they don’t cover all the services patients need and come with annual limits on benefits or other unwelcomed surprises like excluding coverage for a cancer diagnosis as a ‘pre-existing condition.’ For patients with cancer, this can lead to astronomical costs and difficulty affording care.

Brian has Stage II lymphoma. When he has a plan that does not include ACA protections, he pays almost 5 times as much. Maintaining the ACA’s critical patient protections and making sure these protections apply to as many people as possible is crucial to keeping costs affordable for cancer patients.

ACS CAN Fights for Solutions

ACS CAN strongly supports the continuation of the patient protections in the ACA and opposes any efforts to dismantle the legislation without replacing these protections. ACS CAN also urges policymakers to consider prohibiting or limiting the availability of short-term limited duration and other non-ACA compliant plans, or requiring these plans to follow ACA rules.

The Costs of Cancer report uses hypothetical scenarios of typical cancer patients like Brian to show what patients pay and their challenges affording care. Read more about Brian, the costs of his cancer care, and policy solutions to keep costs down.

Download a PDF of this infographic

Download a PDF of this infographic (Spanish)

Insurance Disruptions & the Cost of COVID-19

The Problem

The upheaval to the U.S. economy caused by the pandemic has resulted in many Americans losing their jobs and their employer-provided health insurance. Mid-year coverage disruptions are costly because cancer patients like Franklin who have already met their deductible and maximums near the beginning of the year must pay another deductible and reach their new maximum out-of-pocket amount when they start their new insurance plan. And this problem is disproportionately affecting people of color, who are losing their jobs at higher rates than white workers during the pandemic.

Franklin, who has prostate cancer, already spent $3,000 on his cancer treatment when he lost his job in layoffs related to COVID-19. Starting a new plan cost him another $8,000 to pay his new deductible and out-of-pocket maximum. By the end of the year, Franklin will have spent almost 3 times more on his health care than he would if he’d been able to stay on his employer’s plan.

Insurance disruptions aren’t the only cost of COVID-19 for cancer patients. The pandemic has also resulted in delayed or canceled appointments, which can allow a patient’s cancer to grow, leading to higher treatment costs and worse health outcomes.

ACS CAN Fights for Solutions

ACS CAN is surveying cancer patients to understand how the pandemic is affecting them and advocate on their behalf. Learn more about their experiences at fightcancer.org/survivor-views.

The Costs of Cancer report uses hypothetical scenarios of typical cancer patients like Franklin to show what patients pay and their challenges affording care. Read more about Franklin, the costs of his cancer care, and policy solutions to keep costs.

Download a PDF of this infographic

Download a PDF of this infographic (Spanish)

Some Patients Lack Access to Lower-cost Drug Alternatives

The Problem

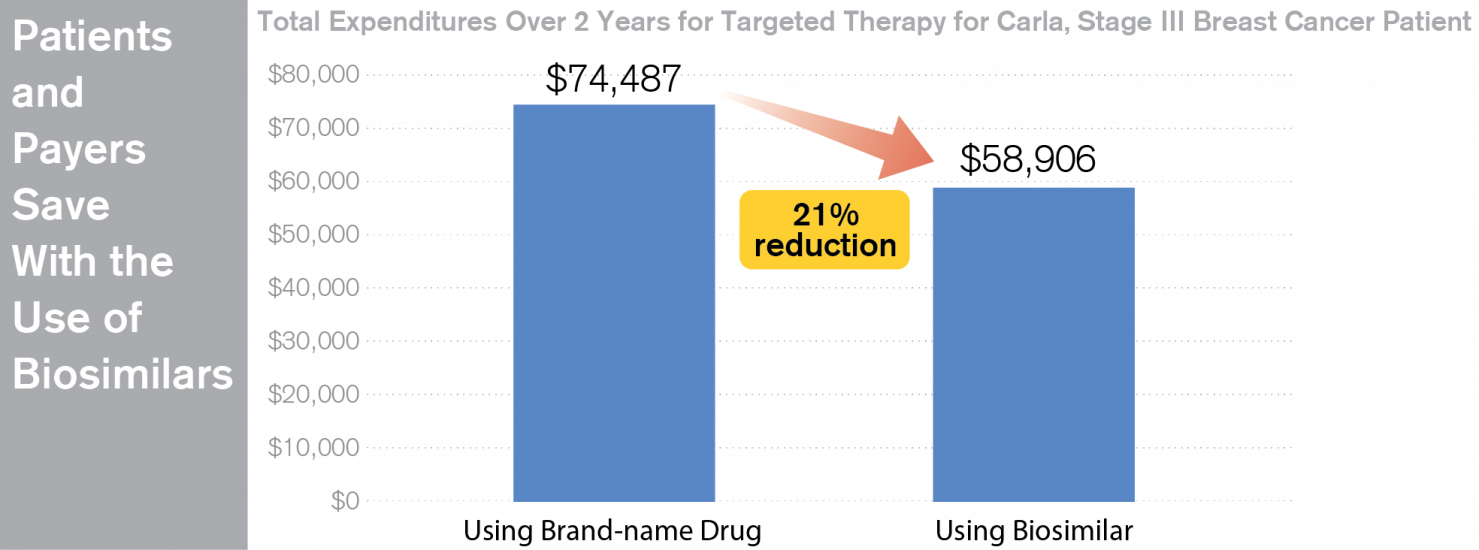

Many cancer patients take multiple drugs as part of their treatment – often for many months or years. While drugs are not the only costly part of cancer treatment, finding ways to reduce these costs for patients and payers will significantly reduce the overall cost burden of cancer. Biosimilars and generics are lower cost alternative versions to some cancer drugs that may become available after the original drug manufacturer has sold their brand exclusively for a few years. But some patients are not aware that there might be a lower cost alternative to their cancer drug. They also may not know whether their plan covers lower cost alternatives.

Carla’s targeted therapy for her stage III breast cancer cost her and her insurer nearly $75,000 over two years. If she had access to a biosimilar, those overall costs would have decreased by over 20%.

ACS CAN Fights for Solutions

ACS CAN supports efforts to ensure biosimilar and generic drugs are available to patients either through prescription from their doctor or appropriate substitutions at the pharmacy. ACS CAN also encourages policymakers to explore ways to incentivize the use of biosimilars through reducing or eliminating cost sharing for patients.

The Costs of Cancer report uses hypothetical scenarios of typical cancer patients like Carla to show what patients pay and their challenges affording care. Read more about Carla, the costs of her cancer care, and policy solutions to keep costs down.

Download a PDF of this infographic

Download a PDF of this infographic (Spanish)

Overall Cancer Costs are Rising

The Problem

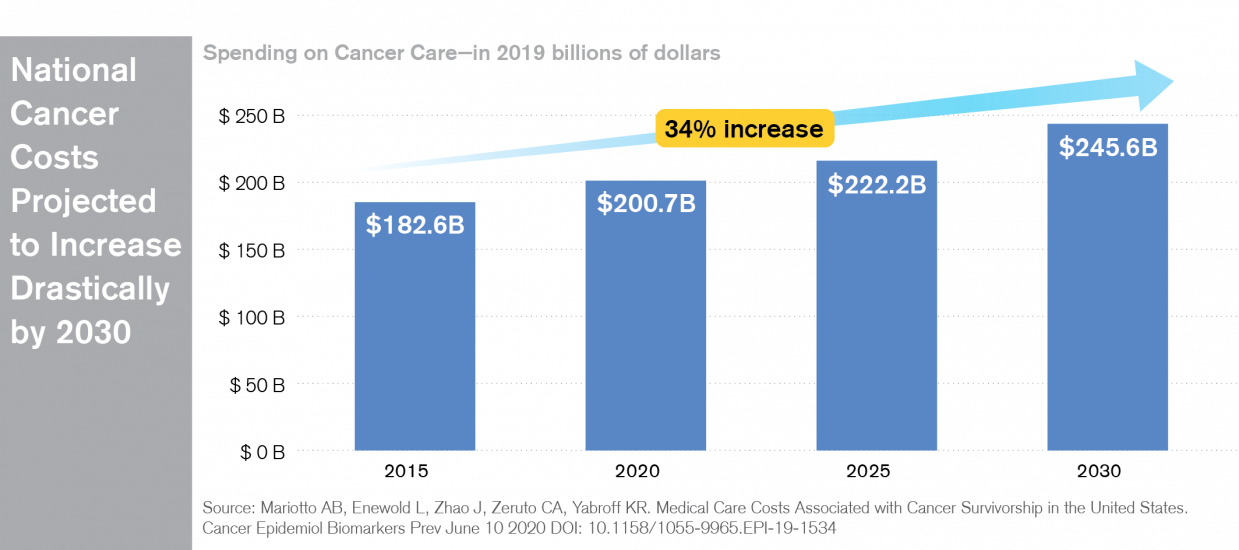

The U.S. spent approximately $183 billion on cancer-related health care in 2015. This represents a signification portion of the total health care spending in the U.S. And it is expected to keep growing. By 2030 cancer-related health care spending is expected to reach nearly $246 billion. These high costs are paid by many people – individual cancer patients and their families, employers, insurance companies and taxpayers.

ACS CAN Fights for Solutions

ACS CAN wants to ensure that all individuals can afford the right health care services at the right time, no matter where they are in their cancer journey. This includes preventive services, cancer screenings, cancer therapy and survivorship care. To make this happen, policymakers must focus on ensuring affordable access to insurance coverage and health care services, and reducing the overall financial impact of cancer for patients and families. Policymakers can also limit costs of cancer by pursuing policies that promote cancer prevention and early detection.

Download a PDF of this infographic

Download a PDF of this infographic (Spanish)

High Deductible Health Plans Cause Extreme Spikes in Cost

The Problem

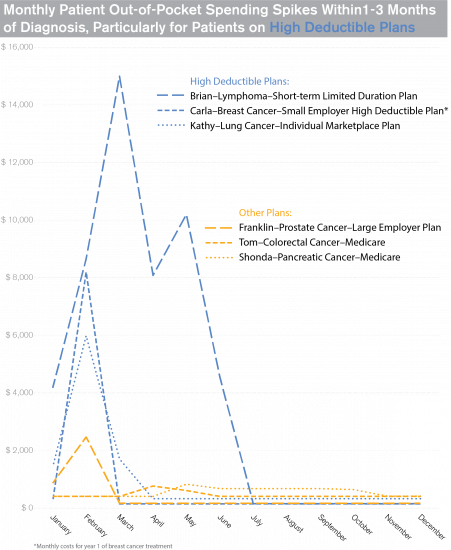

Most patients experience spikes in their health care costs around the time of a cancer diagnosis as they pay their deductible and out-of-pocket maximum. For patients on high deductible plans, this spike can mean bills due for several thousands of dollars within one month. High deductibles often cause individuals to delay or forego care due to cost, which means it may take longer to get a cancer diagnosis and begin life-saving care. And the number of people enrolling in high deductible plans is on the rise.

ACS CAN Fights for Solutions

ACS CAN is concerned about increasing enrollment in high deductible health plans, and how this affects cancer care. ACS CAN supports policies that increase enrollment assistance services to help people understand insurance plans and how much they will have to pay up-front for care. ACS CAN also supports policies to ensure certain health care services are available for free or low cost so that patients don’t delay or forego important prevention and early detection services.

Download a PDF of this infographic

Download a PDF of this infographic (Spanish)

Spikes in Cost Increase the Burden of Affording Cancer Care

The Problem

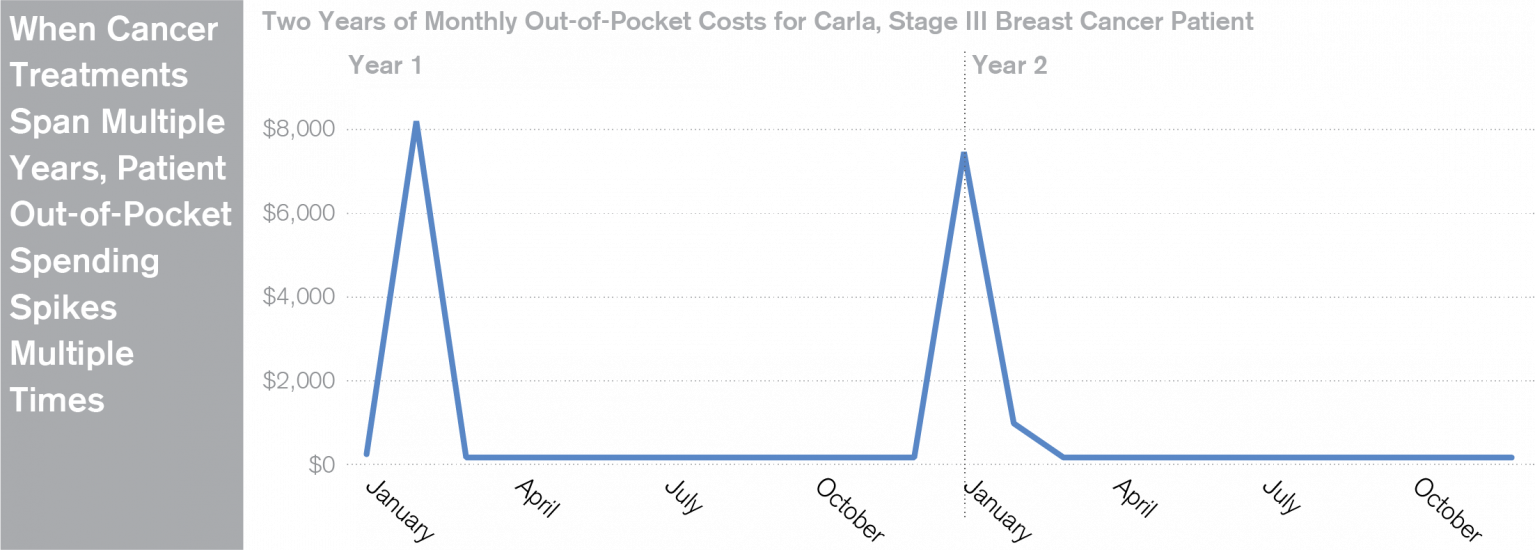

Cancer patients are particularly vulnerable to spikes in their health care costs because many expensive diagnostic tests and treatments are scheduled within a short period of time, so cancer patients spend their deductible and out-of-pocket maximum quickly. These costs can be difficult to manage over the course of a year, and most monthly budgets simply can’t afford these large bills.

Over the two years that Carla is in treatment for stage III breast cancer, she experiences a spike in cost of over $8,000 in the first two months of each year. While she may be able to afford to spend this much on her care spread over the whole year, it is just too much to pay all at once. All the while, her other bills don’t stop, and she’s trying to manage the stress of her cancer diagnosis.

ACS CAN Fights for Solutions

ACS CAN supports policies that would allow patients to “smooth” out their payments over the course of the year rather than pay their entire deductible, maximum out-of-pocket, or other large amount in just 1-2 months – much like consumers can pay for a new car in installments through a payment plan. Such policies can help patients avoid spikes in their costs and hopefully avoid other financial challenges that so often accompany a cancer diagnosis.

The Costs of Cancer report uses hypothetical scenarios of typical cancer patients like Carla to show what patients pay and their challenges affording care. Read more about Carla, the costs of her cancer care, and policy solutions to keep costs down.

Download a PDF of this infographic

Download a PDF of this infographic (Spanish)