Survivor Views: Cancer & Medical Debt

Overview:

The American Cancer Society Cancer Action Network (ACS CAN) gives voice to cancer patients and survivors on critical public policy issues that affect their lives. As part of this effort, ACS CAN deploys surveys to better understand cancer patient and survivor experiences and perspectives, through our Survivor Views research panel. The panel is a group of cancer patients and survivors who respond to regular surveys and provide important insights to support ACS CAN’s public policy work at all levels of government.

Fielded February 9 through 23, 2022, the latest survey explores cancer patients’ and survivors’ experiences and concerns with medical debt associated with the cost of cancer care. The web-based survey was conducted among 1,218 patients and survivors nationwide diagnosed with or treated for cancer in the last seven years. The margin of sampling error associated with a sample of this size is +/-2.8% at a 95% confidence level. The research provides important insights into the sources and impacts of medical debt on cancer patients and survivors.

Key Findings:

- Majorities of cancer patients and survivors say they were unprepared for what the costs of their care would be, and most report making major changes to their lifestyle or finances as a result.

- Cost concerns weigh heavily: 73% are concerned about their ability to pay current or future costs of their care and 70% are worried about incurring medical debt due to their cancer care and treatment.

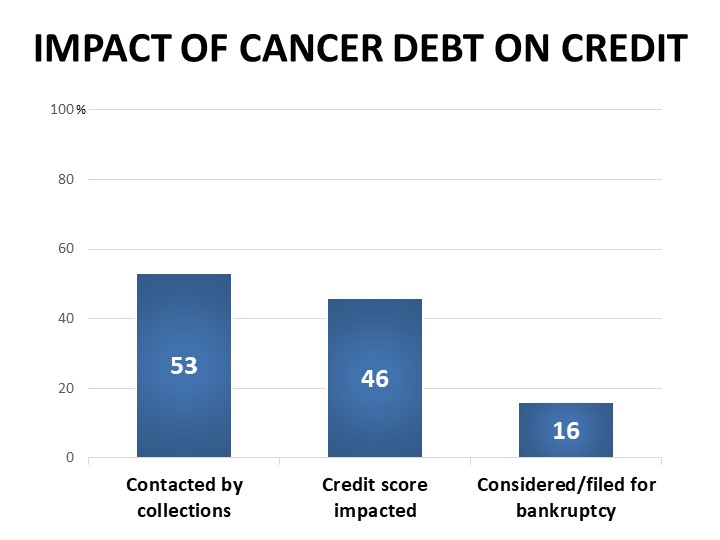

- In line with recent national reports, 51% of cancer patients and survivors report incurring medical debt as a result of the costs of their cancer care. The debt is often carried for years with significant impacts, including 53% of debt-holders facing collections and 46% seeing their credit score negatively impacted.

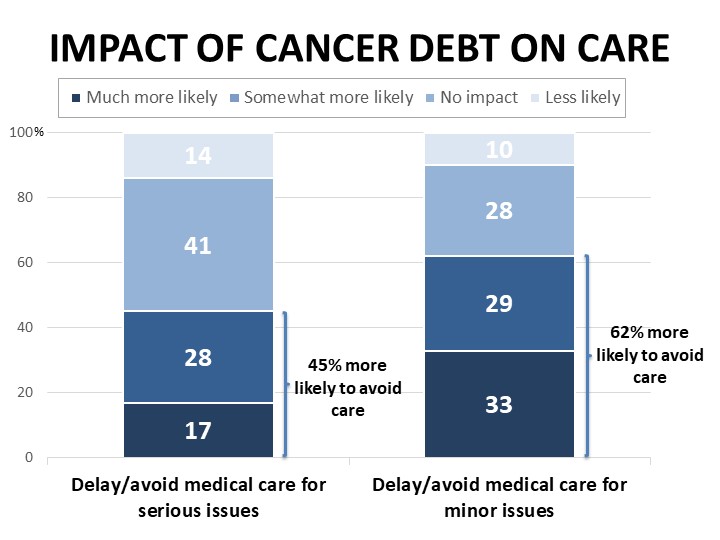

- Experiences with medical debt can hinder seeking care and limit treatment option: 45% of those who have had medical debt have delayed or avoided medical care for serious issues as a result, and 62% have delayed or avoided medical care for minor issues, while half have sought the least expensive treatment options due to their debt.

- The cost burden associated with cancer care is not felt equally. African Americans in our survey are more likely to report having medical debt associated with their cancer care, and more likely to have been contacted by collections regarding their debt. Residents of states that have not yet or only recently expanded Medicaid are also more likely to report having medical debt, as well as higher rates of feeling unprepared for the costs of their cancer care.

Detailed Survey Findings:

Cancer Patients and Survivors Have Significant Concerns About Their Ability to Pay for Their Care

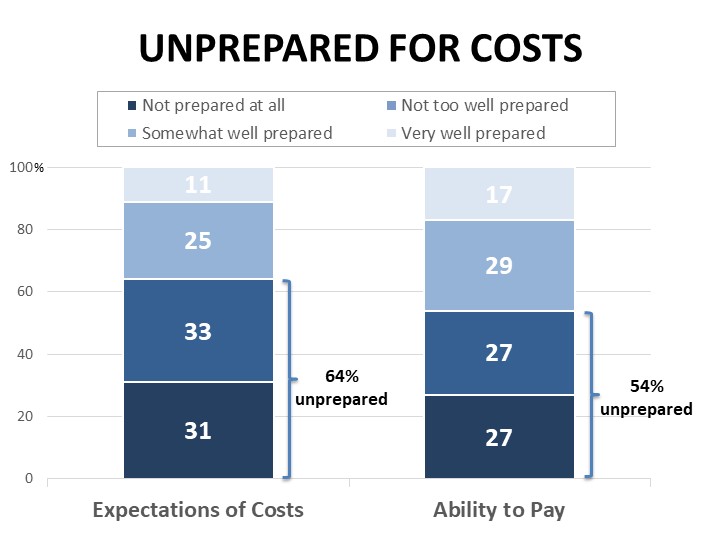

M ajorities of cancer patients and survivors surveyed feel they were unprepared for the costs of their cancer care, both in terms of their ability to pay (54% unprepared) and in terms of what they expected the costs would be (64% unprepared). Women, younger respondents, and those with lower household income are significantly more likely than others to say they felt unprepared for the costs. Those living in Medicaid expansion states are almost twice as likely as those in states that have not expanded Medicaid to say they felt very prepared for the costs of their cancer care (see methodological note at end for details of the states included in this analysis).

ajorities of cancer patients and survivors surveyed feel they were unprepared for the costs of their cancer care, both in terms of their ability to pay (54% unprepared) and in terms of what they expected the costs would be (64% unprepared). Women, younger respondents, and those with lower household income are significantly more likely than others to say they felt unprepared for the costs. Those living in Medicaid expansion states are almost twice as likely as those in states that have not expanded Medicaid to say they felt very prepared for the costs of their cancer care (see methodological note at end for details of the states included in this analysis).

Seventy-one percent have made significant changes to their finances in response to the costs of their care, such as putting off vacations or major purchases (39%), cutting back on food, clothing, and basic household expenses (36%), using up all or most of their savings (28%), or increasing credit card debt (28%). In addition to credit card debt, 20% report borrowing money from friends or family and 7% have taken out another type of loan, while borrowing from a payday lender and refinancing a home were each mentioned by 4%.

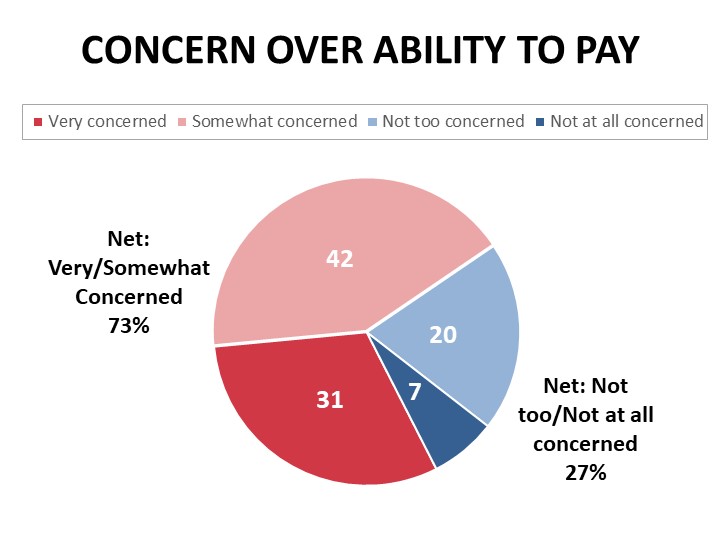

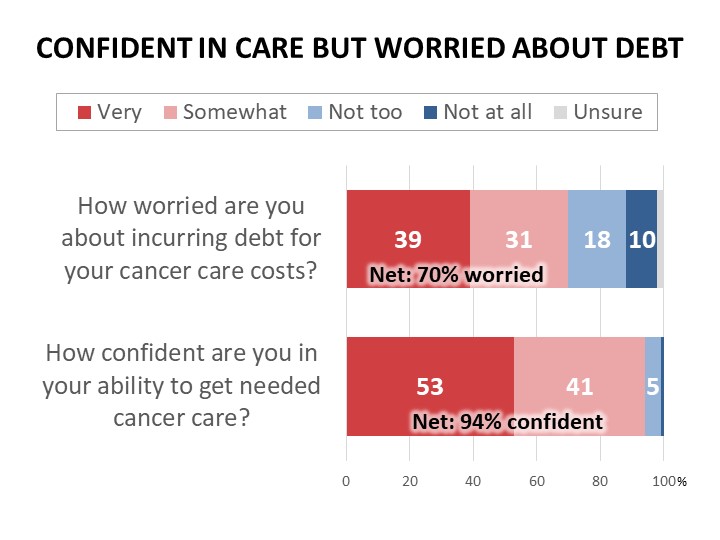

Nearly three-quarters of cancer patients and survivors (73%) are concerned about their ability to pay current or future costs of their cancer care, and 31% are very concerned. This level of concern is consistent regardless of whether the respondent is currently in treatment or how long it has been since their last treatment, and many mention their risk of future recurrences or new cancers. Women, those with lower household income, and those with less than a college-level education are especially concerned about their ability to pay. Unexpected medical bills (78%) and services not covered by insurance or for which coverage is denied (77%) are most worrisome, followed by incurring medical debt due to costs of care (70%). Majorities are also worried about the costs of prescription drugs (65%) and their insurance deductibles (65%) and premiums (56%).

Half Report Accumulating Medical Debt Due to the Costs of Their Cancer

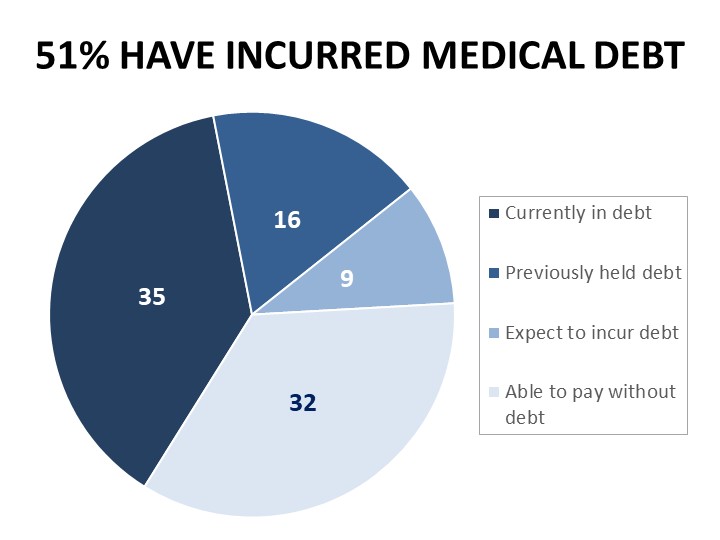

Mirroring recent national reports, 51% of cancer patients and survivors surveyed report carrying medical debt due to the costs of their cancer, with 35% reporting they currently have unpaid medical bills or other debt incurred to cover costs of their care, and 16% who have since paid off their debt. Medical debt is impacting cancer patients and survivors regardless of insurance coverage and across income levels: 99% of cancer patients and survivors in this survey have health care coverage and 56% report household income above the US median. Women are more likely than men to report medical debt (57% vs. 36%), and African Americans and more likely than whites to report medical debt (62% vs. 52%). Respondents in Medicaid expansion states are more likely than others to say they expect to be able to pay for their cancer care without incurring debt (34% vs. 27%), while those in states that have not expanded Medicaid are more likely to report medical debt associated with their cancer care (58% vs. 49%).

Mirroring recent national reports, 51% of cancer patients and survivors surveyed report carrying medical debt due to the costs of their cancer, with 35% reporting they currently have unpaid medical bills or other debt incurred to cover costs of their care, and 16% who have since paid off their debt. Medical debt is impacting cancer patients and survivors regardless of insurance coverage and across income levels: 99% of cancer patients and survivors in this survey have health care coverage and 56% report household income above the US median. Women are more likely than men to report medical debt (57% vs. 36%), and African Americans and more likely than whites to report medical debt (62% vs. 52%). Respondents in Medicaid expansion states are more likely than others to say they expect to be able to pay for their cancer care without incurring debt (34% vs. 27%), while those in states that have not expanded Medicaid are more likely to report medical debt associated with their cancer care (58% vs. 49%).

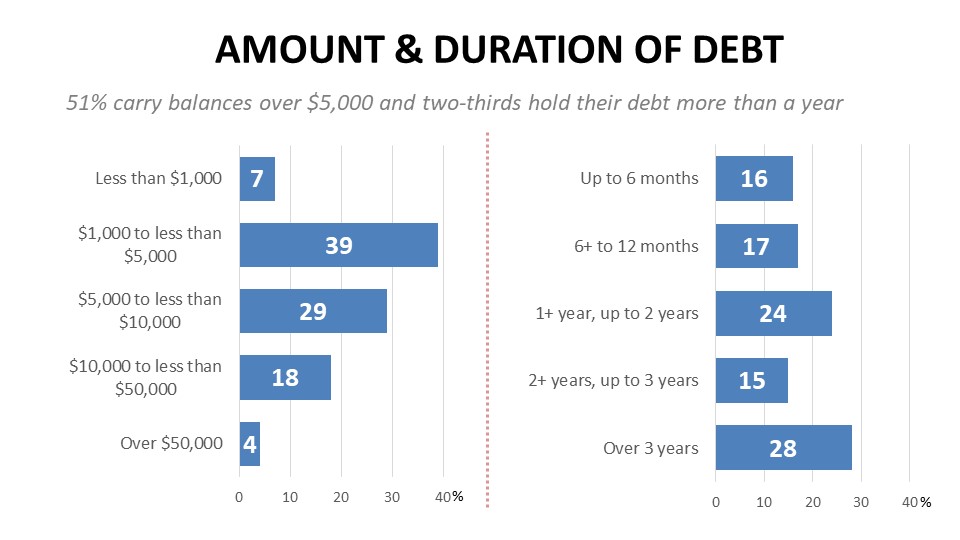

Significant debt burdens are often carried for years. More than half of debt-holders report balances of over $5,000 while nearly a quarter (22%) had over $10,000 in debt related to their cancer care. Two-thirds carried their debt for more than a year, while 28% were in debt for more than three years. The impacts of medical debt on cancer patients and survivors are often considerable. Over half of those shouldering medical debt related to the costs of their cancer care have been in collections, and 46% say their credit score was impacted. Four percent report filing for bankruptcy and another 12% have considered it. African Americans are significantly more likely than whites to report facing collections for their medical debt (69% vs. 50%).

Sixty-two percent of debt-holders have delayed or avoided medical care for minor issues due to their debt, and 45% have delayed or avoided care for serious issues. Women, younger respondents, and those residing in rural areas are most likely to say they have delayed or avoided care due to their experience with medical debt. Half have attempted to compare prices among providers or seek the least expensive treatments possible. Eighty-four percent say their experience with medical debt has led them to support legislation that would make major changes to the health care system.

Most say their cancer-related medical debt was accumulated during active treatment (78%), but 52% also incurred debt post-treatment, for costs such as on-going screening, monitoring, surveillance, or rehabilitation, and 39% began the process in arrears with debt incurred during the diagnostic phase. Hospital bills are the most frequently cited provider sources of debt (83%), far exceeding the number citing bills from their oncologist (37%), another physician type (33%), independent labs (29%), or pharmacy bills (17%). While surgeries top the list of services causing debt at 54%, the range of services contributing to debt is more widespread, with imaging and diagnostic testing each mentioned by 44%, followed by chemotherapy (38%), radiation (27%), pharmacy drugs (21%), physical therapy and rehabilitation (13%), and immunotherapy (9%).

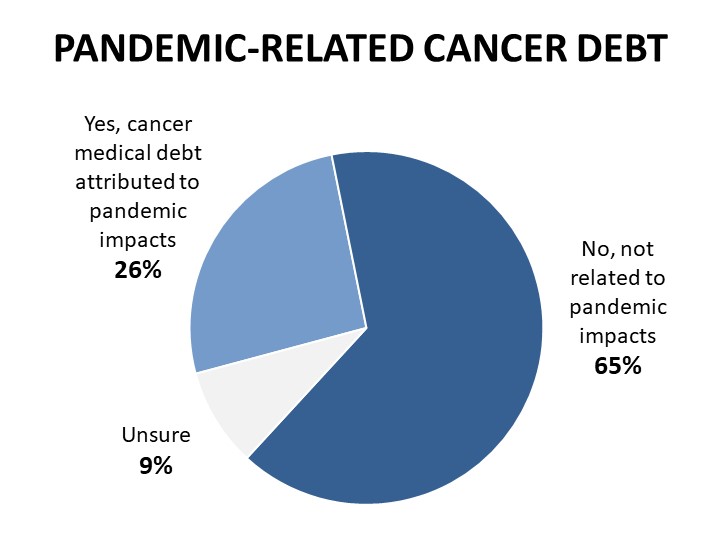

Twenty-six percent attribute at least some of their cancer-related medical debt to the on-going impacts of the covid-19 pandemic, such as due to changes in income, employment, or health care coverage caused by the pandemic.

Cancer Patients and Survivors Share Stories of Medical Costs and Debt Impeding Needed Care

Within the survey, respondents had the opportunity to share their experiences with managing the costs of their cancer care or debt accumulated as a result. Nearly five hundred personal accounts were submitted, and the comments illustrate the considerable stress associated with concerns about medical debt, including preventing patients from receiving needed care:

- “The cost of the biopsy, hospital charges and all have me afraid to have anything else done because of the debt. It has gone to collections and they call and harass me which causes me fear of losing what little I have.”

- “My heart was damaged due to chemo and I have delayed going to the cardiologist because I still have debt.”

- “We are in collections from the surgeries I had for breast cancer. I recently found a nodule on my lung and they wanted me to pay up front so I cancelled the appointment. I’m also delaying my breast MRI until my HSA renews.”

- “My insurance put a 6 month hold on paying for anything, saying they needed to look into my case. My oncologist said I didn't have 6 months to waste. So we took out $20,000 from a retirement fund to pay for the surgery.”

- “I have used all of my savings and have a huge amount of debt incurred for my treatment. It’s very hard to feel hopeful living in fear of cancer and under a lot of debt. I have also had issues with getting follow up care because I am behind on my bills.”

- “I was fortunate enough to be placed on immunotherapy. Unfortunately, the cost is very high so each month I owe money and have even had my wages garnished due to the high cost. It's embarrassing and makes me feel ashamed.”

- “My treatment was spread over two years, so I had to meet my deductible twice. During the second year, my employer changed insurance companies and I had to meet yet another deductible. In addition, the insurance decides what expenses and amounts count towards out-of-pocket expenses that I had to meet before insurance would pay. It makes it very difficult to go to the doctor, never being sure what is covered and what is not covered.”

While most say they have not experienced negative health outcomes from their cancer that they believe are linked to their medical debt or difficulty paying for care, 16% feel they have suffered negative impacts such as delayed diagnosis, longer recovery times, or recurrence due to cost-related delays in care. Those in lower income households, those with less than a college-level education, and those residing in urban areas are more likely to feel they have suffered negative health outcomes related to their medical debt or difficulty paying for care.

While the overwhelming majority (94%) are confident in their ability to get the care they need related to their cancer (53% very confident and 41% somewhat), most (70%) worry that it comes at the expense of medical debt to cover the costs of care.

Methodology:

ACS CAN’s Survivor Views research initiative was designed to enhance the organization’s mission to end suffering and death from cancer. Data provided by cancer patients and survivors as part of this project allows for a greater understanding of their experiences and opinions on cancer-related issues and gives voice to cancer patients and survivors in the shaping and advocating of public policies that help prevent, detect, and treat cancer and promote a more positive quality of life for those impacted.

To ensure the protection of all participants in this initiative all research protocols, questionnaires, and communications are reviewed by the Morehouse School of Medicine Institutional Review Board.

The survey population is comprised of individuals who meet the following criteria:

- Diagnosed with and/or treated for cancer within the last seven years

- Over the age of 18 (parents of childhood cancer survivors were invited to participate on behalf of their minor children)

- Reside in the US or US territories

Potential Survivor Views participants were invited to participate through email invitations, social media promotion, and partner group outreach. Those who agreed to participate after reviewing the informed consent information completed a brief survey including demographic and cancer history information to inform analysis as well as topical questions as discussed in this document. The data were collected between February 9-23, 2022. A total of 1,218 participants responded to the survey, providing a margin of error +/-2.8 percentage points at a 95% confidence level.

Note: The following categories were created for the analysis of states that have expanded Medicaid versus those that have not yet or have expanded too recently for significant impacts to yet be measurable by this survey instrument:

- Expansion States (68% of respondents):

- AK, AR, AZ, CA, CO, CT, DC, DE, HI, IA, ID, IL, IN, KY, LA, MA, MD, ME, MI, MN, MT, ND, NE, NH, NJ, NM, NV, NY, OH, OR, PA, RI, UT, VA, VT, WA, WV

- Recent or Non-Expansion States (32% of respondents):

- AL, FL, GA, KS, MS, NC, SC, SD, TN, TX, WI, WY and OK (enrollment began 6/21), MO (enrollment began 8/21)

About ACS CAN

The American Cancer Society Cancer Action Network (ACS CAN) is making cancer a top priority for public officials and candidates at the federal, state and local levels. ACS CAN empowers advocates across the country to make their voices heard and influence evidence-based public policy change as well as legislative and regulatory solutions that will reduce the cancer burden. As the American Cancer Society’s nonprofit, nonpartisan advocacy affiliate, ACS CAN is critical to the fight for a world without cancer.